“Inflation is taxation without legislation.”

— Milton Friedman

Greetings Investors, Happy New Year! It’s time to catch up on the serious developments in the financial markets. I have been running a private investment advisory newsletter in which I pick a “Top Ten” Portfolio for four years now. In 2008, I did not issue a “Top Ten” portfolio based on the fact that I thought it would be a very difficult year to invest. As we now know, that may have been the understatement of the century.

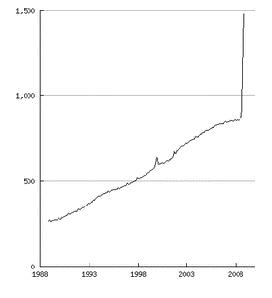

Twelve months later, as we start 2009, the investment landscape has changed dramatically. The investment banking industry has been obliterated. Fannie Mae, the largest mortgage buyer on the planet, has been taken over by the U.S. government. The federal government has expanded its balance sheet to over $1 Trillion (the truth is, nobody knows by exactly how much) and is taking large stakes in private businesses. We’re becoming “Francified” as the country moves toward large-scale socialization of industry.

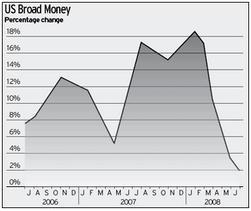

Where does it all lead? Unfortunately, Americans aren’t very good at making baguettes, so the “Francification” isn’t a good look for us. As the government takes on more and more liabilities of the private enterprise, prints up money, and seeks to bail out the economy by the creation of new public debt, this could lead to the largest inflationary bubble of our lifetime.

Nearly all asset classes were destroyed in 2008: Equities, corporate bonds, municipal bonds, real estate, oil, industrial commodities. Almost everything was down 40-60%. I guess we can take solace in the fact that we weren’t Iceland, where the stock market declined 95%! There were really only two places to hide: 1) Gold, of which I have been a big fan (and still am), which ended the year up 5% 2) Treasury bonds, which mounted their largest rally in history. 2009 will certainly throw a few curveballs.

I believe we will see a “divergence in asset classes.” As the government prints more money, expands its balance sheet, and becomes the public dumpster of all toxic assets that caused the collapse in the market, savvy investors are likely to run for the cover of assets that would hold their value in an inflationary environment as global governments begin a mad race to “print the most money.”

I believe the “stuff” trade will be back on, as people protect themselves against the coming inflation. As Jim Rogers, the commodities investor and founder of the Quantum fund has pointed out, commodities do not have “impaired” fundamentals. That is, the fundamentals for many commodities, especially agricultural commodities, remain incredibly strong (for example, wheat stocks are at their lowest point in history while global demand for food hits new highs).

To sum up the problem: In 2009, you might not be able to buy a new Escalade on bank credit, but you will need to eat and buy food. Financial assets, including government balance sheets, are, in fact, impaired. Nobody knows where the federal government balance sheet will end up after this process, nor what it will be valued at.

Some corporate earnings numbers are also big question mark, especially in the retail sector. To invest in treasury bonds at this point for a measly a 2% yield looks like one of the worst risk/reward trades in history. In fact, I advocate:

* Shorting Treasury bonds and believe it may be one of the best trading opportunities in a long time.

* Precious metals and agricultural commodities are likely to outperform.

* Energy will return, but likely later in the year, after the precious metals and grains. It is interesting that major diversified oil companies such as Chevron (CVX) has stabilized ahead of crude oil, and we think that is a favorable sign for energy stocks.

* The stock market could see a benefit from the return to liquidity, and for that reason it would not surprise me to see the market rally for the next 2-3 months. It is a good time to test the equity waters with some high- quality dividend-producing stocks, if only because they are a decent hedge against inflation and the dividend “pays you to wait.” But take it slow and easy! Dollar-cost averaging rules, and have a long time horizon.

* High-quality corporate bonds are also interesting. Individual corporate bonds take a lot of work to understand and I am no expert, therefore I am going to stick with some reputable funds, including the BlackRock Income Opportunity Trust. However, any stock market rally should be seen skeptically and sold accordingly. I doubt that a new bull market can emerge in 2009 because of issues with corporate profits.

It’s unlikely that corporate profits will return to the giddy growth of the 2003-2006 period because of under-investment and a consumer that is returning to saving. Our stock picks are weighted to things that might be impervious toward a prolonged recession, including healthcare and biotech. In general, I am expecting that the stock market will be a trader’s market in 2009, with violent chops up and down.

This year, our first portfolio “goes to 11” because we like to add another unit of diversification to our approach. Without further ado, here is my “Top Ten Portfolio” for 2008.

Top Ten Portfolio 2009 – The “Macro Portfolio”

1) Gold – Either iShares Gold (GLD) or gold futures (I prefer to play futures and physical)

2) Silver – Can be bought as 1) coins on eBay 2) iShares ETF (SLV) 3) Silver stocks like PAAS or SSRI 4) Silver futures (be careful, silver is notoriously volatile) 5) physical bars other than coines. Believe it or not, I own ALL OF THE ABOVE!

2) DBA – Powershares Agriculture ETF

3) BNA – Blackrock Income Opportunity Trust

4) BPT – BP Prudhoe Trust

5) CVX – Chevron

6) BMY – Bristol Myers

7) MCD – McDonalds

*) BDX – Becton Dickinson

9) GILD – Gilead Sciences

10) TBT – Double Short Treasury Bonds (Note: you are selling bonds short when buying this ETF)

11) Corn & Wheat futures (those of you who can’t buy futures can substitute DBA)